- Fundamentals of Budgeting –

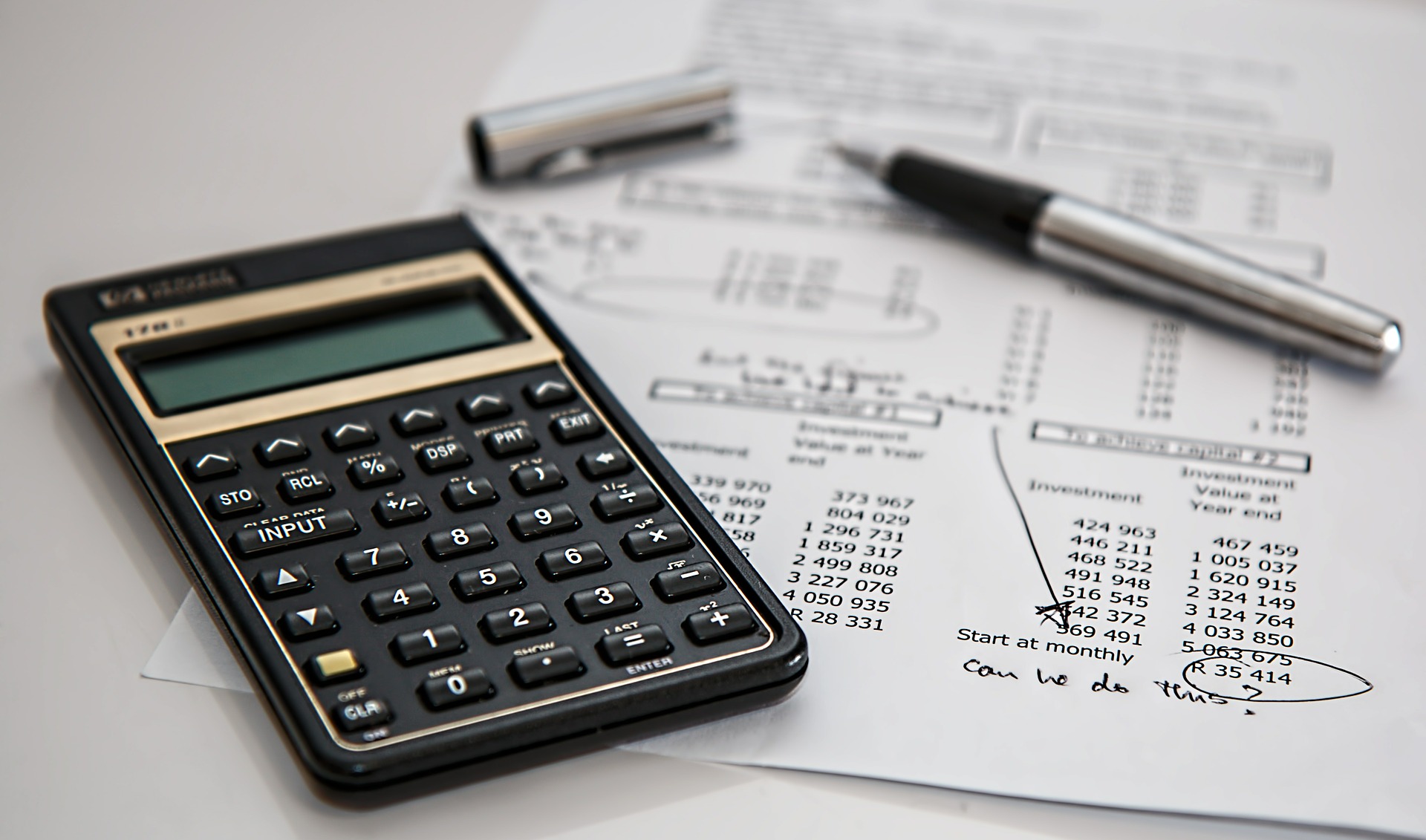

Being able to prepare and maintain a budget is one of the most fundamental yet crucial aspects of financial literacy. In the age of digitization on a global scale, it is quite easy to create a budget with the help of various online tools such as websites and apps. For example, Mint.com and other online platforms. These tools are capable of helping you keep track of your money so that you are held accountable for whatever comes in and goes out.

- Interest Impact –

The subject of interest is briefly touched upon in mathematics at various levels, but the detail concept is essential to be familiar with. Aspects of interest such as compound interest etc. are crucial awareness topics to call yourself financially literate.

- The new savvy is saving –

Savings are one of the most vital aspects of financial literacy lessons and also the most undermined. It is quite easy to neglect important things like retirement as it is something that you don’t see happening in the near future and therefore is seemingly less important. Regardless, learning to save early in life is responsible as it helps you get into a routine and thus avoid unnecessary expenditure. Savings not only maintain your financial health, but they also teach you early lessons on the value of money.

- Lessons on Credit-Debt –

The most suffering population of the lot with regard to credit-debit concepts is the student population. Most students are unable to manage their credit and end up in situations wherein they lose out on it all. This is the reason that it is vital to spread awareness about credit and debit related concepts. Credit can prove to be an extremely useful tool if managed the right way. Youngsters are known to make rash decisions that cost them a lot in return.

- Issues concerning Identity Theft & Safety-

Security issues are the most common and most dangerous of the problems we face today. This is largely due to the growing digitization process across the globe. Regardless of who you are, you will have to use an online platform to conduct a transaction at some point in your life. At such a juncture, it is essential to keep your financial information safe from fraud. Some things that you can do are set password protection, limit the amount of data you give out, etc. The steps mentioned above will help save you from a potential financial downfall caused solely due to negligence. Although it is not foolproof, it is vital to safeguard finances to the best of our ability in order to avoid such threats.